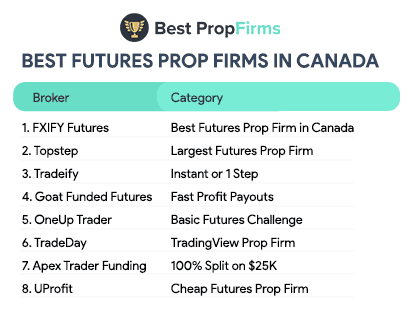

Best Futures Prop Firms in Canada

These are the top futures prop firms available to Canadian traders in 2025. We’ve ranked each by score, payout terms, platform access, and challenge style. Many well-known firms don’t support Canadian residents, so this list focuses only on those that do.

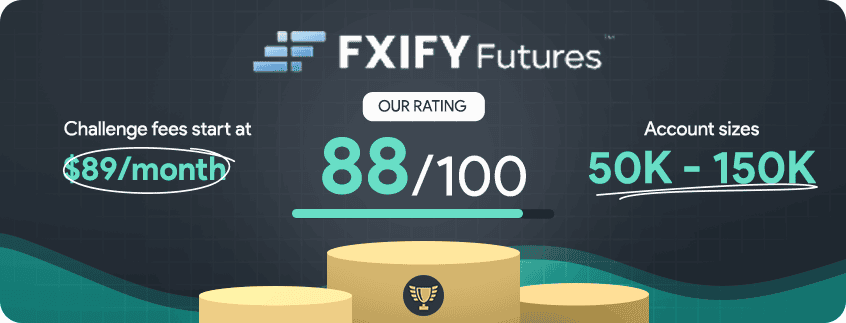

FXIFY Futures is ranked 1st in Canada with a top score of 88/100 in our

FXIFY Futures is ranked 1st in Canada with a top score of 88/100 in our

Ask an Expert