Tradeify Review

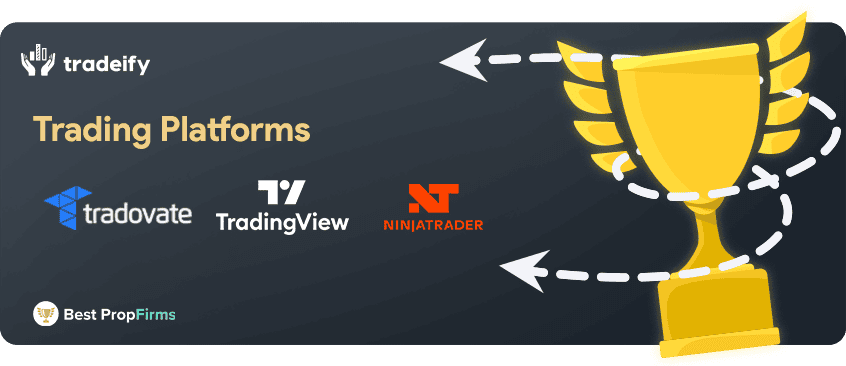

Tradeify scored 82/100 when our research team tested and reviewed the popular US futures prop firm. As well as being broker backed and offering Tradeovate, TradingView and Ninja trader are available, as well as instant futures funding.

The Advanced Challenge is built for active intraday traders. It’s a one step evaluation with no time limits, but you pay an ongoing monthly fees starting at $69, as well as a $125 activation fee to get your live funded account after you pass.

The Advanced Challenge is built for active intraday traders. It’s a one step evaluation with no time limits, but you pay an ongoing monthly fees starting at $69, as well as a $125 activation fee to get your live funded account after you pass. The Growth Challenge is Tradeify’s other one step evaluation, and better suited for swing or position traders. It has softer risk constraints than the Advanced challenge and no activation fees, but you’ll be paying higher monthly fees between $139 to $339 depending on account size.

The Growth Challenge is Tradeify’s other one step evaluation, and better suited for swing or position traders. It has softer risk constraints than the Advanced challenge and no activation fees, but you’ll be paying higher monthly fees between $139 to $339 depending on account size. This is Tradeify’s instant funding option where you skip the challenge altogether. You pay a one off fee from $349 to $729 and and there’s no pass or fail evaluation stage.

This is Tradeify’s instant funding option where you skip the challenge altogether. You pay a one off fee from $349 to $729 and and there’s no pass or fail evaluation stage.

Tradeify holds a 4.8 out of 5 rating on Trustpilot from over 700 verified reviews. About 93% of those are five-star, and the feedback leans heavily positive.

Tradeify holds a 4.8 out of 5 rating on Trustpilot from over 700 verified reviews. About 93% of those are five-star, and the feedback leans heavily positive.

Ask an Expert